My mother-in-lawm. Each time she stepped out, I heard strange voices outside. When I finally saw what it was, I couldn’t move.

When I told Josh I wanted a home birth, his face lit up like a child on Christmas morning. But his mother, Elizabeth, was even more excited. You would have thought we had just given her the keys to a shiny new car.

Oh, Nancy! This is such great news!” Elizabeth exclaimed, putting her hands together. “I have to be there to support you both. I can help with anything you need!”

I looked at Josh, raising my eyebrows. His shrug told me he was leaving the decision up to me.

I don’t know, Elizabeth,” I replied, sounding unsure. “It’s going to be really intense.”

She waved my worries away. “Nonsense! I’ve been through this myself. I know exactly what you’ll need.”

I bit my lip, thinking it over. Maybe having an extra pair of hands wouldn’t be so bad, right? It would also mean a lot to Josh if I invited his mother to help with our home birth.

“Okay,” I finally agreed. “You can be there.”

Elizabeth squealed with delight, her excitement so loud it could have scared the neighborhood dogs.

The big day finally came. Our midwife, Rosie, was setting up her things when Elizabeth rushed in, her arms full of bags.

“You won’t regret this, Nancy,” she said, hugging me tightly. “I promise to be the best support you could ask for.”

“I’m here!” she announced, as if we could have missed her entrance. “What do you need me to do?”

I was about to respond when a contraction hit, taking my breath away. Josh was instantly by my side, his hand on my lower back as I tensed and groaned.

“Just… put your things down for now,” I managed to say.

As the contraction passed, I noticed Elizabeth fidgeting, her eyes darting around the room. She seemed more nervous than excited, and I felt that something was off.

“Are you okay?” I asked, frowning.

She turned, startled. “What? Oh, yes! Just thinking about how I can help. You’re doing great, honey. Just keep pushing.”

Before I could ask her anything else, she rushed out the door, mumbling something about getting me some water.

Josh squeezed my hand. “Want me to talk to her?”

I shook my head. “No, it’s fine. She’s probably just nervous. It’s our first baby, right?”

As my labor went on, Elizabeth’s behavior became stranger. She would pop in, ask how I was doing, then leave again. Each time she returned, she seemed more flustered.

During a strong contraction, I held Josh’s hand so tightly I thought I might break it. As the pain faded, I heard a weird sound.

“Josh,” I panted, “do you hear that?”

He tilted his head to listen. “Sounds like… voices?”

I nodded, relieved I wasn’t imagining it. “And is that music?”

Josh frowned, kissed my forehead, and said, “I’ll check it out. I’ll be right back.”

As he left, Rosie smiled at me. “You’re doing great, Nancy. Not long now.”

When Josh came back, he looked pale, like he had seen a ghost.

“What is it?” I asked, dreading his answer.

He ran his hand through his hair, looking upset. “You’re not going to believe this. My mother is throwing a party. In our living room.”

I stared at him, thinking I must have misheard. “A what?”

“A party,” he repeated, frustration in his voice. “There are at least a dozen people out there.”

The pain of labor was nothing compared to the anger that flooded me. I struggled to get up, ignoring my midwife’s protests.

“Nancy, you shouldn’t—”

“I need to see this for myself,” I growled.

Josh helped me as we made our way to the living room. The scene was surreal. People were chatting and drinking, as if it were a casual Sunday barbecue.

A banner hung on the wall that read: “WELCOME BABY!”

Elizabeth was in the middle of it all, chatting with a group of women I didn’t recognize. She didn’t even notice us.

“What the heck is going on here?” I shouted, my voice slicing through the chatter.

The room went silent, all eyes on us. Elizabeth turned around, her face going pale when she saw me.

“Nancy! Oh my God! What are you doing here? You’re supposed to—”

“Elizabeth, what is happening here?”

“Oh, I… we were just…”

“Just what? Turning my home birth into a show?”

Elizabeth looked offended. “Now, Nancy, don’t be dramatic. We’re just celebrating!”

“Celebrating? I’m in labor, Elizabeth! This isn’t a party!”

She waved her hand dismissively. “Oh, you wouldn’t even know we were here! I thought you’d like the support.”

I felt another contraction coming on and gritted my teeth against the pain and anger. “Support? This is a circus!”

Josh stepped forward, his voice low and serious. “Everyone needs to leave. Now.”

People scrambled to grab their things, and Elizabeth tried one last time. “Nancy, you’re overreacting. This is a happy time!”

I turned to her, my words sharp. “This is my home birth. My moment. If you can’t respect that, you can leave too.”

Without waiting for a response, I waddled back to the bedroom to finish what I started, leaving Josh to handle the chaos.

Hours later, as I held my newborn son, the earlier drama felt like a distant nightmare. Josh sat beside me, eyes full of wonder as he stroked our baby’s cheek.

“He’s perfect!” he whispered.

I nodded, too overwhelmed for words. We enjoyed the quiet until a soft knock at the door broke the peace.

Elizabeth peeked in, her eyes red. “Can I… can I come in?”

My jaw tightened. “No!”

Her face fell. “Please, Nancy. I’m so sorry. I just want to see the baby.”

I looked at Josh, feeling torn. He squeezed my hand gently, his eyes understanding but pleading.

“Fine. Five minutes.”

Elizabeth walked in slowly, as if worried I might change my mind. Her face looked pale and drawn as she came closer to the bed.

“Nancy, I’m so sorry. I don’t know what I was thinking. I got so excited and carried away.”

I didn’t respond, just stared at her. Josh cleared his throat. “Do you want to see your grandson, Mom?”

Elizabeth nodded, tears falling as Josh carefully handed our son to her. As she held him, her whole demeanor changed. The party-planner was gone, replaced by a gentle, awed grandmother.

After a few minutes, I spoke up. “It’s time for him to feed.”

Elizabeth nodded and reluctantly gave the baby back to me. She lingered at the door. “Thank you for letting me see him,” she said softly before leaving.

As the door closed, Josh turned to me. “Are you okay?”

I shook my head. “No. What she did… I can’t just forgive and forget, Josh.”

He nodded and pulled me close. “I understand. We’ll work it out together.”

In the weeks that followed, I struggled with how to move on. Part of me wanted to keep Elizabeth away from our son’s first celebration as revenge for her party crash.

I was still angry and hurt, which made it hard to think about including her.

But as I watched her care for our baby during her visits, always respectful of our space and routines, I realized there was a better way.

When it was time to plan the baby’s first party, I picked up the phone and called her.

“Elizabeth? It’s Nancy. I was hoping you could help with the preparations for the baby’s party next weekend.”

There was a long silence on the line. Finally, she spoke. “You want my help? After what I did?”

“Yes. Because this is what family does. We forgive, learn, and move forward together.”

I could hear tears in her voice as she replied, “Oh, Nancy. Thank you. I promise I won’t let you down.”

True to her word, Elizabeth was calm and helpful during the party. She worked quietly in the background, glowing with pride as we introduced our son to family and friends.

As the last guest left, she came up to me, her eyes shining. “Thank you for letting me be part of this, Nancy. I see now that this is how we celebrate: with love and respect.”

I smiled, feeling the barriers between us break down. “That’s right, Elizabeth. Welcome to the family!”

Man has been saving up pennies for 45 years – Bank tellers are at a loss for words when he arrives to cash in

“Penny saved is a penny earned” is a saying that people who are good at managing their finances believe to be true.

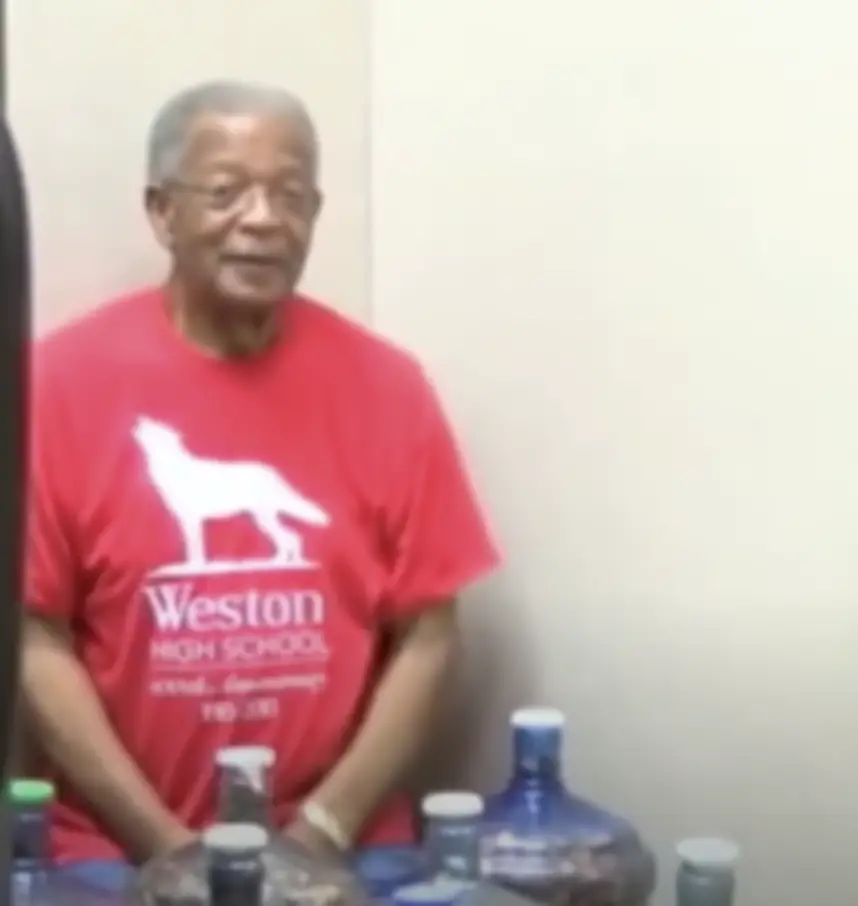

Otha Anders, a former teacher from Louisiana, had been collecting pennies for a very long time. It all started as a goal of collecting pennies he would find on the street, and it soon turned into a passion he couldn’t say no to. Over the course of 45 years, this man had managed to fill in 15 5-gallon jugs of change before he finally decided to cash the pennies in 2015 when his homeowner’s insurance stopped covering the collection.

Speaking of his achievement which left the clerks at the bank totally stunned, Anders told ABC News: “If I would see a penny when I’m gassing up, on the ground, or in a store, it would be a reminder to stop right there and say a prayer. I never failed to do that. That’s why they had so much value to me.

“I would never spend a penny,” he told USA Today. “I would break a dollar before giving up a penny.

“I wanted to fill five five-gallon water jugs. That was the goal, but I couldn’t stop. … If I hadn’t turned them in yesterday, I was not going to stop,” he said.

Everyone who knows Anders knew of his passion and his collection. Even the kids at the school where he worked. He would sometimes buy pennies from them, but he would never take, not even a single one, without paying for it.

“I never allowed anyone, not even my wife nor children, to give me pennies without being compensated,” he told USA Today. “I wanted the inner satisfaction that God and I acquired this collection.”

When he arrived at the Ruston Origin Bank in Ruston, Louisiana, the staff welcomed him in and were more than happy to assist him. For his stunning collection of pennies, Anders got $5,136.14.

Take a look at the video below to learn more about Anders and his collection.

Leave a Reply