A wife was left shocked when she came home one day and found her children’s nanny wet after stepping out of the shower. What was even more surprising was that her husband was there and he sided with the nanny when his wife showed concern!

A woman with wet hair and body smiling | Source: Pexels

I CAUGHT MY KIDS’ BABYSITTER DOING THIS WHILE I WASN’T HOME! Okay, here’s the backstory, my hubby and I hired a babysitter for our three children as we’re both slammed with work all the time. Everything had been fine until yesterday… I walked in at 6 p.m., and there she was with her hair all wet!

She said she had to shower because my kiddo spilled milk on her. The babysitter was hired and is paid by me to look after mine and my husband’s children, all under six. She tried reassuring me by saying the children were fine while she showered quickly because they were napping.

A woman drying her hair with a towel after showering | Source: Pexels

“I still don’t think it’s appropriate for you to shower in my home though,” I replied in frustration. The 23-year-old brushed my concerns aside and argued that it wasn’t a big deal. As we went back and forth on the matter, my husband suddenly appeared in the living room!

I was more confused that my husband was home and on top of that he sided with the babysitter, but I insisted that I was uncomfortable with what happened. My feelings were dismissed by both parties and the babysitter left to go home. But here’s where it gets totally weird – my husband, who’s supposed to be at work at that time doing the night shift, is right there at home!

Two women having a disagreement | Source: Pexels

My gut told me something totally wrong occurred and I just couldn’t stop thinking that they were having an affair. So, the next day, before leaving for work, I decided to dig out and turn on the dusty old nanny camera that I’d been using when my children were babies. I secretly set it up in the living room before I headed to work.

The day started like any other, with the usual morning rush of getting the children ready, making breakfast, and kissing my husband goodbye as I left first for work with the babysitter passing me at the entrance. Or so I thought. Little did I know, my world was about to turn upside down!

A woman drinking a beverage while looking at something on her laptop | Source: Pexels

Not even an hour later, I checked the camera and saw MY HUSBAND, who’d left for work, walking in the door. My heart just dropped when he approached our nanny. Tears blurred my vision as I watched, unable to comprehend the scene unfolding on the small screen of my phone.

In a daze, I told my boss I felt sick and needed to go home, though the sickness I felt was one of betrayal and heartache. Rushing home, driven by a mix of dread and a desperate need for answers, I expected the worst. Yet, what I found was my husband at the cooker, preparing food.

A man making a meal at a stove | Source: Pexels

The sight left me dumbfounded. Confusion clouded my mind as I tried to reconcile the images from the nanny camera with the man standing before me. Was I cheated on or WHAT?! My husband, sensing my distress, turned to me with a look of worry.

“Why are you home so early?” he asked. I told him they let me go home early because of a power outage that brought the systems down. He seemed to accept my story before saying, “Honey, I have to tell you something,” his voice heavy with guilt. The confession that followed was one I could never have anticipated.

An upset woman talking to a man holding a paper and water | Source: Pexels

He admitted to being afraid to tell me the truth that a week ago he was fired due to downsizing at work. My spouse said he hadn’t wanted to bother me with it and decided to pretend that he was going to work. Instead, he would return home, look for jobs online, and help with taking care of the children, adding:

“Yesterday indeed our daughter spilled milk on our nanny so I told her to go and wash everything while I was there to take care of the kids who were napping.”

A man holding a laundry basket with clothes | Source: Pexels

The incident with the babysitter? “A simple accident,” he explained, that he had handled so I wouldn’t have to worry. He intended to support me by keeping the household running smoothly in the face of his own crisis. As he shared his struggles, I felt a whirlwind of emotions.

Guilt for not noticing the signs of his distress, anger for being kept in the dark, but also compassion for the fear and love that drove his actions. It was a sobering reminder of the unseen battles we each face, hidden behind a facade of normalcy.

A couple having a serious conversation | Source: Pexels

“That’s why I was home yesterday. And why the nanny was… it was an accident, really,” he added, hoping to clarify the misunderstanding. “But why didn’t you just tell me?” I asked, struggling to keep my voice steady.

“I was afraid,” he admitted. “Afraid of how you’d react, and seeing disappointment in your eyes. I wanted to fix it before you had to worry about it too.” We sat down at the kitchen table, in a silent agreement to talk it out.

A couple having a serious conversation | Source: Pexels

“And the nanny?” I finally asked, needing to know more about that day. “She was just as surprised as you are about all this. She’s been really understanding, considering the awkward position we put her in,” he explained.

I nodded, taking in his words, the anger slowly dissipating. “I owe her an apology then. And… thank you, for trying to keep things running smoothly. I just wish you had told me.” He reached for my hand across the table. “I know. I’m sorry. From now on, no more secrets. We’ll get through this together.”

A couple holding hands across a table | Source: Pexels

That night, we had a long-overdue conversation. It was painful, yes, but also cathartic. We discussed the importance of openness and honesty, acknowledging the strain our silence had placed on our marriage. The realization that we had both been trying to shield each other from hardship, at the cost of our connection, was a poignant moment.

A couple arranging an agreement with a woman | Source: Pexels

The babysitter, unwittingly caught in our family drama, became an unexpected catalyst for change. We apologized for the misunderstanding, grateful for her understanding and the care she had shown our family during a confusing time.

Two women and a man having a conversation | Source: Pexels

My husband and I promised to keep her on, not just as a babysitter, but as someone who had demonstrated remarkable responsibility and compassion. In the end, this challenging ordeal brought to light the strength and resilience of our family.

A couple embracing on a couch | Source: Pexels

It reminded us that in times of hardship, the bonds of love and understanding can see us through the darkest times. It was a lesson in the importance of communication, a reminder that the weight of the world is easier to bear when shared with those we love.

A couple holding hands while bonding in the bedroom | Source: Pexels

Here is a quick synopsis of a similar tale that might interest readers:

Kate and her husband, Dan’s nearly a decade-long relationship is put to a brief but intense test. The couple, blessed with three children leads a busy yet fulfilling life, with Dan working as a university professor and Kate as a wedding photographer.

A happy couple playing with a child | Source: Pexels

Their life, filled with the demands of work and family, is supported by their nanny, Ella, whose dedication and affection for the children are unmatched. The story takes a turn one evening when Kate returns home unexpectedly early from a trip, only to find Ella, their trusted nanny, leaving their house at an unusual hour.

This encounter sparks a whirlwind of suspicion in Kate’s mind, especially when Ella’s explanation and Dan’s subsequent, uneasy excuse about borrowing a book feel insufficient and out of place. The seeds of doubt, once sown, grow rapidly, leading Kate to search her husband’s office.

A woman searching through desk drawers | Source: Pexels

She discovers a black box containing what appears to be wedding rings. This discovery further fuels her anxiety, prompting fears of betrayal and a hidden life. Confronting Dan with the box and her fears, Kate demands the truth.

A woman holding a small wrapped box | Source: Pexels

The tension peaks, only for Dan to reveal a heartwarming secret. His intentions, obscured by secrecy and misunderstandings, finally come to light, showcasing his true feelings for Kate. Ella’s involvement, too, is clarified.

After A Teacher Corrected A Student’s Test, The Whole Town Wanted Her Fired

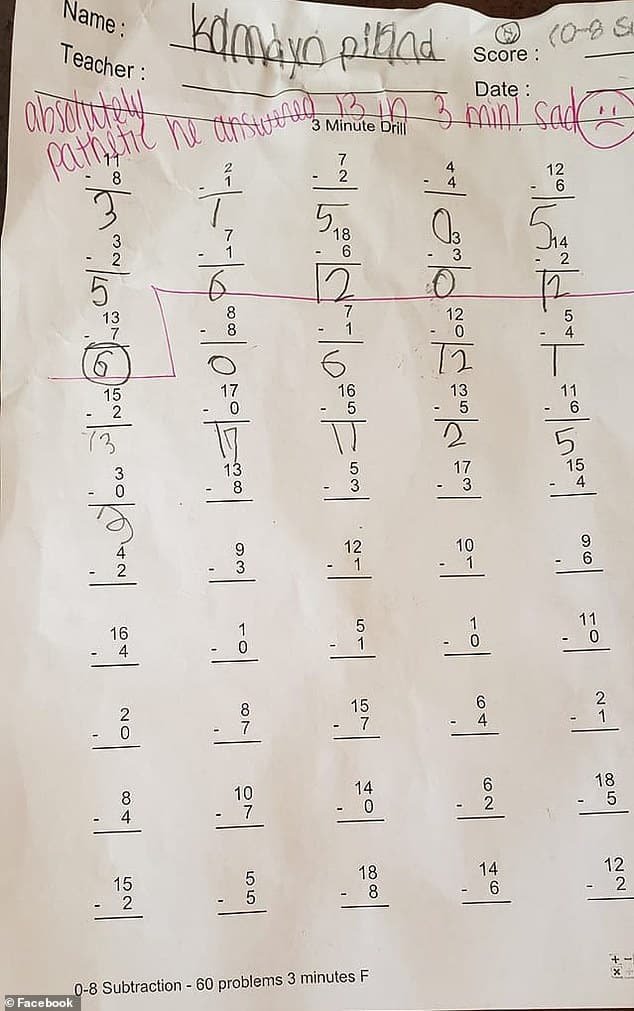

Pennsylvania father Chris Piland was appalled to see what his second-grader’s teacher had written on a paper that the student had turned in. In addition to bullying Piland’s young child, the instructor tried to make him feel foolish and humiliate him in front of his peers—exactly the opposite of what educators should be doing if they are committed to helping pupils learn.

What action did the teacher then take? The word “absolutely pathetic” was scribbled over the tiny boy’s assignment. Piland is now asking for the teacher’s termination due to the disrespectful remark.

Because they are employed at Valley View Elementary School, the teacher takes pleasure in getting paid on a regular basis. However, they have recently come under fire for misusing their authority over the children. Piland discovered that the teacher isn’t doing their job, in addition to learning that the teacher finds his young son’s intelligence to be “absolutely pathetic.”

The instructor has already been announced as Alyssa Rupp Bohenek. She wrote her remarks using a red pen, a symbol of subpar work from pupils. The entire sentence said:

How pathetic! In just three minutes, he responded to thirteen questions! wistful She grimaced in response to that.

The purpose was to determine the number of subtraction problems the second graders could complete. The teacher gave the class three minutes to finish them, and she was horrified to see that Piland’s son, who had the lowest performance in the class, could only finish thirteen of them.

Piland called Bohenek out for her animosity after she uploaded the assignment’s photo online.

“My son, Kamdyn’s teacher, has been so cruel to him and me for the entire year. That someone would write this on a child’s assignment and then bring it home enrages me beyond measure. Adorable source of inspiration,” he said next the image.

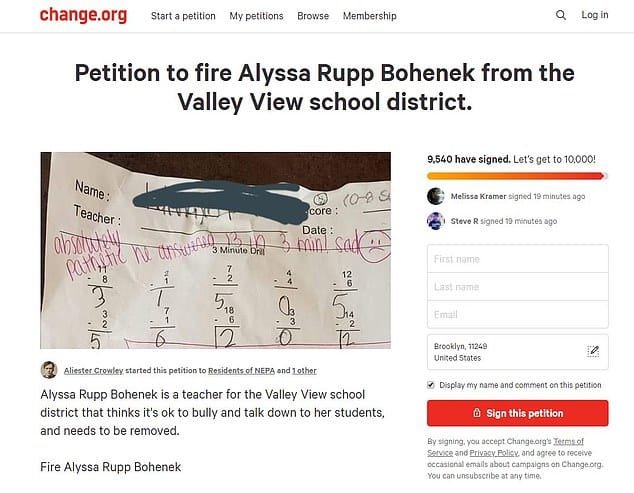

Piland didn’t want the teacher to get away with her crime against his child, so he started an online petition to try and have her fired so she could no longer abuse her position over any other young second-grade pupils.

The outrage compelled Rose Minniti, the superintendent of schools, to respond. She stated that she was informed about the test last week and that she has already set up a meeting with the teacher who is accused to investigate the allegations and decide if firing the teacher is the appropriate course of action.

According to Minniti, social media won’t affect how this personnel case turns out. The proof and the facts will decide it. We constantly try to strike a balance between the needs of the kids and the requirements to safeguard the worker who is the focus of the inquiry.

Bohenek has worked at the elementary school since 2013. Has she gotten tired of looking after the little children already? Based on the look of her response, it appears that she is over it.

Leave a Reply