A greedy brother inherits a house and mocks his younger sister, who only gets five rusty old clocks from their late grandmother. Little did they know about what was hidden in those timepieces.

“Oh, so grandma called you as well?! I thought you’d be busy in the library…like a good little bookworm!” 26-year-old Brian scoffed at his younger sister Linda, 19.

She had just stepped down from the taxi. Fear filled her eyes as her heart told her: “Nothing will happen to grandma. She’ll be fine. She’ll live for a hundred years more.”

Brian and Linda had come to visit their 90-year-old granny Marlene. She had requested them to see her urgently.

“Sweethearts, I wish to see you one last time. I might not get another chance again,” Marlene had painfully told them on the call two days ago…

As Linda entered her grandma’s bedroom, she coughed, noticing that it was pretty dusty. Marlene was too old and sick to do things on her own. She hadn’t swept the floor, and Linda saw the ceiling was moldy due to leakage.

Linda opened the clock, and what she found inside would go on to change her life.

“Grandma!!” she ran and hugged Marlene, who was in bed. “Nothing will happen to you, grandma. Please don’t worry. God will not take you away from us because you are all that we have.”

Until a year ago, Linda lived with Marlene. She took good care of her and helped her a lot. She was even ready to turn down a life-changing scholarship but moved to the city to pursue her degree upon Marlene’s insistence.

Brian entered the room, coughing and grinning. “Damn…I’m allergic to dust! Grandma, didn’t you sweep and dust your room?”

He came closer and saw his grandma was sick and skinny. But he was least bothered and stood there, waiting to know why she had called them.

Marlene stared into Brian’s eyes as she clasped Linda’s shivering hands. The girl was pained to see her grandma so pale and her eyes lacking that once beautiful spark. They looked lifeless.

Marlene smiled, getting up gently, and took two envelopes from under her pillow. “Sweethearts, this is for you,” she said. “Please use it wisely. I called to give it to you.”

Brian and Linda opened the envelopes and found a wad of $5,000 in each.

Linda could not hold back her tears and ran out crying.

Meanwhile, Brian frowned. “Only this much? I thought you had more to spare. Fine, I have to go now.” He turned his back on Marlene and walked away without even thanking her.

The next day, Marlene was in for a surprise.

“Good morning, grandma!” Marlene heard Linda in her bedroom. She didn’t expect her to return.

She awakened as the girl undrew the curtains, shafts of beams lighting up the dark, dusty bedroom.

She was surprised to see Linda. She had thought the girl had left for the city where she studied and was a part-time librarian.

Linda walked over to Marlene with the envelope she had given her the previous day.

“I added the $4,000 I’d saved over the year. Grandma, remember you told me about your poor vision? I now have $9,000. We can now pay for your eye surgery.”

Marlene rose from her bed. She hugged Linda, tears streaking her face. “I knew you better, darling! But it’s too late for the surgery. I can sense my death nearing. I don’t want to waste this money when it can be used for something better.”

Linda wiped away Marlene’s tears and said she would live with her.

“I’ve taken a month off. I’m not going anywhere until I see that golden smile on your face, grandma.”

And Linda knew what she had to do to restore Marlene’s smile.

Having Linda around was of great help to Marlene. She didn’t have to worry about cooking for herself.

There were days when Marlene would eat stale bread for dinner when she never felt like making herself a nice meal. But after Linda came, she started feeling on her feet again. Marlene had never felt so relaxed and happy before.

One day, she heard strangers’ voices outside her bedroom and went out to check. She was surprised. Linda had spent the $9,000 on renovating the house and fixing the leakage.

“I knew you wanted to repair grandpa’s treasured house for a long time. Are you happy now, grandma?! I renovated it so that you see the beautiful house you once lived in with grandpa. Do you like it?”

Marlene was speechless. She walked to Linda as fast as her fragile legs could carry her and hugged her. Marlene had never cried like she wept on Linda’s shoulders that day.

Marlene often made a wish. “I want to die when I’m the happiest on earth!” A week later, her wish was fulfilled. Marlene died in her sleep, leaving Linda with more than a broken heart.

A couple of days after the funeral, Linda and Brian were called to the lawyer’s office regarding the late Marlene’s will they never knew about.

When they got there, they were told about another surprise inheritance.

“Mr. White, according to your grandma’s will, you’ll be getting her house. Here are the papers. Please sign them.”

Linda was startled. She was not jealous of her older brother, but it worried her because she had renovated the house, and Brian got it when he least deserved it.

“And Miss Linda, this is yours,” the lawyer said, pushing forward a box toward Linda.

“What is this?” she exclaimed and opened the box. She found five old vintage clocks inside. Brian burst into laughter and began mocking her.

“That’s hella insane and cheap!! Grandma left her house to me. She knew who deserved the best. You can decorate your rented apartment with these rusty clocks and cry over it, sis. Luck does not favor everyone!”

Distraught, Linda left for the city, taking the clocks with her. She never bothered to check them thoroughly until one day when she noticed an engraving on one of them.

“OPEN IT!” was etched in a beautiful cursive font on the metal.

Curious, Linda opened the clock, and what she found inside would go on to change her life.

“A note?” she exclaimed and picked a little scroll from the clock’s interior. She unfolded it and sat back, stunned.

“Never underestimate these rusty, old watches! They are 100-year-old classic timepieces that belonged to my grandfather. And they are crafted from rare, exquisite metal! Each piece is worth $40,000, my dear!” began the note.

Linda’s eyes filled with tears of joy as she read further.

“Everyone gets what they truly deserve, Linda! I’m glad you got only the best. With Love, Granny Marlene.”

Linda burst into tears as she held the vintage clocks close to her heart. They still functioned, and she could hear them tick close to her heartbeat. It felt as though her granny had not gone anywhere.

Linda chose not to disclose this to her brother.

“He is blinded by greed and thinks he got the best from grandma. Let him live with that assumption. Granny knew who deserved the best and I needn’t prove it to him!” she thought and kept the rare timepieces locked in her drawer.

What can we learn from the story?

Everyone gets what they truly deserve. Brian mocked Linda when she inherited only five old clocks from their grandmother. Little did he know that she had actually gotten what she truly deserved because each piece was worth over $40,000.

Love and accept your elders for who they are. You will be loved back a hundredfold. Linda loved her grandma unconditionally and cared for her without expecting anything in return. Ultimately, she inherited a surprise $200K worth of legacy after her granny’s death.

Share this story with your friends. It might brighten their day and inspire them.

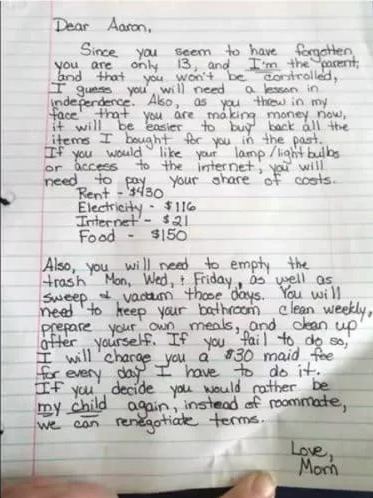

Mom Leaves Note On “Disrespectful” Son’s Door, And Now It’s Going Viral

Being a parent to a cocky, disrespectful teenager is far from easy, and different parents have different approaches to get their children to behave.

One mom, Heidi Johnson, wrote a handwritten letter to her son, Aaron, and shared it on Facebook. She didn’t intend for the post to go viral. She didn’t even intend to make the post public. It was supposed to just be for friends to see, but she does not regret her post or the fact that it’s public.

In the letter to her 13-year-old son, Johnson reprimanded her son treating her like a “roommate.” She went on to give him an itemized bill for rent, food, etc that totaled over $700. If he was going to treat her like a roommate instead of his mom, she would do the same.

Johnson signed the note, “Love Mom,” and she truly does love her son. She followed up the post with another post explaining some backstory to the situation. She also reassured parents who were criticizing her that “I am not going to put my 13 year old on the street if he can’t pay his half of the rent. I am not wanting him to pay anything. I want him to take pride in his home, his space, and appreciate the gifts and blessings we have.”

She added that she never intended for Aaron to pay the bill. Instead, she wanted him to “gain an appreciation of what things cost.” The reason Johnson wrote the note was to make sure her son understood “what life would look like if I was not his ‘parent,’ but rather a ‘roommate.’ It was a lesson about gratitude and respect from the very beginning.”

Johnson also explained that before she wrote the note, her son had lied about doing his homework, and when she told him she was going to restrict his internet access, he responded, “Well, I am making money now.” She explained that the money he was referring to was a little bit of income he was making from his YouTube channel, but not nearly enough to pay for food and rent.

The public note has not hurt Johnson’s relationship with her son. She explained, “He and I still talk as openly as ever. He has apologized multiple times.”

Johnson has also had parents turning to her for advice since she posted the note to her son. She explains, “My post seems to have opened a door, and people feel safe coming to me and asking for advice, venting, or even just have someone bear witness to their experience by listening and opening up and sharing a piece of myself in return.”

Leave a Reply